Application Management and Patching

In the Future World of EUC, Shifts Happen

Technology shifts are inevitable, especially in the dynamic world of Virtual Desktop Infrastructure (VDI), Desktop-as-a-Service (DaaS), universal endpoint management (UEM), and application management within end-user computing (EUC). Over the past decade, these shifts have been gradually taking shape and have now reached a point where organizations must make significant transition or migration decisions.

VDI, DaaS, and Cloud Shift

Application management, UEM, security, and hybrid work are integral parts of the current EUC shift. However, VDI, DaaS, and cloud technologies are emerging as foundational components, supported by recent statistics.1, 2 While VMware, Citrix, and Microsoft are all leaders in the DaaS market, Gartner estimates that Microsoft is the largest vendor in this space.3

Citrix and VMware are undergoing significant shifts in their DaaS, VDI, and platform offerings, driven by their respective acquisitions by Tibco and Broadcom. These changes have included a mix of perpetual and universal licensing updates, the selloff of parts of their EUC portfolios, and major layoffs.

These changes, among others, are driving a hybrid cloud shift as more companies turn to Microsoft for SaaS, DaaS, and endpoint management (Intune). Citrix and VMware’s mergers and acquisitions (M&A), along with ongoing changes in Microsoft’s product offerings, could lead to major long-term improvements for customers. However, the challenge for these and other major platform vendors lies in closing the remaining gaps in delivering the modern workspace. These shifts in the VDI/DaaS EUC space take control out of customers’ hands in several ways:

- Companies with on-premises solutions prefer to make the shift on their own schedules rather than being forced into it.

- Many are assessing transitions and migrations based on factors like cost, time, and the best options for stability and future agility.

- There is no seamless way to integrate these solutions without friction and complexity.

Hybrid solutions, such as those from vendors like Parallels and Dizzion (who acquired Frame from Nutanix),4 aim to bridge these gaps. However, these changes only add to the uncertainty faced by EUC end users who must navigate transitions between vendors in the VDI/DaaS space. Many of these customers are now wondering why they didn’t concentrate on the device for application, access, and control rather than expensive VDI.

UEM, App Management, and Platform Transition Shift

This shift is characterized by a loss of control and options. Microsoft’s upcoming end of life for Windows 10 is likely to pose significant challenges for many companies in the EUC space, particularly regarding version compatibility.5 Microsoft looks to be the clear global market dominating player for cloud EUC. But their mature services contrast with recent changes like Intune across UEM, which brings its own OS and other compatibility challenges across EUC.

Security Shift

A major issue in this shift is the persistent gaps in applications, devices, and security, despite EUC end-users implementing multiple platforms and workspace solutions simultaneously. Application management and UEM are on the front lines of these shifts as delivery, authentication, packaging, versioning, and access management become challenges across different platforms.

The US and Europe see the need for greater security across device landscapes, platforms, enterprise architectures, networks, cloud, and hybrid/on-premises environments. This current shift calls for a major increase in predictive and proactive solution investment rather than the standard reactive approach because of growing cryptoware/ransomware threats.

Platform and UEM Shift

This all takes place as organizations look at migrating or transitioning from one platform to another (Citrix, Nutanix and/or VMware to AVD), along with the need to provide applications across different OS, platforms, and devices. UEM, through growing solutions like Intune via Azure AD, is ushering in new ways of authentication. But in some ways, it hasn’t been the panacea that everyone hoped for as complexities and compatibility slows progress for end users and vendors.

The gaps in UEM and application management all make for a lot of disconnect and authentication concerns across a hybrid cloud, work, and platform landscape. The differences in European and US markets have a lot to do with how each country deals with this broader shift.

US and Europe: Differences in Market Approach

European adoption of Intune has happened quickly, but the size of companies and the channel market ecosystem have made that a smoother transition. This points to a major difference between the US and European markets in terms of their ability to innovate and adopt new technologies faster while avoiding the uncertainty and chaos that shifts can bring.

The US market is a more vendor-direct ecosystem that:

- Is dominated by a focus and landscape of much larger enterprises.

- Has far more complexity where vendors often go for incremental quick wins rather than larger, slow-burn ecosystem rollouts of an entire line of connected solutions.

- Leads to a faster but smaller income infusion (comparatively).

- Requires vendors to almost exclusively focus on reactively solving present pain points, making them less poised for proactive future innovation.

We can see this lack of focus on proactive innovation and agility in the response to the pandemic and remote-work shift in the US. Companies and vendors were forced to cobble together technologies and solutions as stopgaps.

Europe has a more dominant channel market ecosystem that is:

- Driven by more SMEs and fewer massive enterprises like the US

- More capable of faster vendor innovation and greater agility based on creating long-term relationships that foster product suite implementations over time

- Focused on bigger deals with long-term incremental rollout of solution suites based on potential and proven needs, so initial payouts are more conservative but long-term profits are much higher

The Broader Shift to Application and Device Consumption On-Demand

Companies like Apple exemplify the concept of digital experience (DEX) and user control. Apple has developed a DEX that puts the end user in the driver’s seat, allowing transparent access and security for any application on any device. However, it’s the backend control that makes this possible, and vendors in the broader EUC space are beginning to follow suit.

The on-demand DEX world requires solutions that enable that ability without thinking. Technology is a means to an end, so it must be a transparent UX on the front end and technologically flexible, agile, automated, and integrated on the back end. Vendors must stop asking silly questions of end users and just make it work logically to give them the control they need on the front end, because the world is complex enough.

Device enrollment application population, and security must go from taking hours to being instant and transparent to meet end-user demands, which requires:

- More vendor collaboration and integration where possible

- Automation to make things more seamless, simple, and flexible

- Agile technology solutions that make it easy to blend all the different platforms, environments, architectures, devices, and applications on the back end

This consumption on demand world has prompted Microsoft to change the look and feel of Microsoft Intune to be more understandable for end users and IT. Some vendors know what to do, and those that don’t make the shift will not survive.

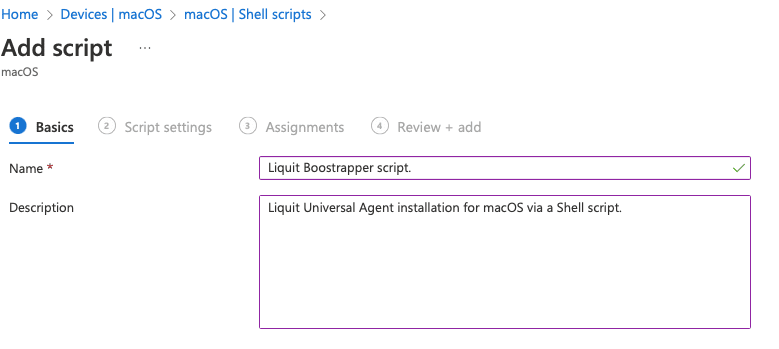

Recast Software and Liquit: A Future-Proof Model Beyond Every Shift

The future of Liquit that is now part of Recast Software, mirrors the possibility for future-proof agility, flexibility, and innovation. They can do this while delivering consistency and scalability regardless of shifting needs in EUC across the US, Europe, and beyond.

With the addition of the Liquit platform to their global offering, Recast Software now represents a microcosm of the US and European market approaches—vendor-to-company and vendor-to-channel. We collectively understand that meeting EUC needs and navigating current and future shifts requires vendors to move along these two paths simultaneously.

The goal is to be agile enough to do whichever is best for any market, client, or scenario. This requires vendors to empower IT with solutions delivering a consistent foundation that can quickly and cost effectively adapt in a future-proof way to changing needs.

We are pointing the way to that new paradigm by showing that it’s not one way or the other on a market or technology level. Recast Software and Liquit part of Recast Software are moving towards empowering their unified team to think, innovate, integrate, and collaborate on behalf of the customer in service to the present and future shifts. This means looking beyond a focus on Microsoft, VMware, Citrix, and other platforms to a broader picture.

The EUC shift is happening now, and past realities are no longer universally true and consistent. Yesterday it was Citrix, and five years ago it was something else. Today, Microsoft has made tremendous changes, but tomorrow will require even more changes for them and every other vendor.

Bibliography

- Worldwide spending for public cloud DaaS expected to top 3.5B in 2024, according to Statista. Other statistics put that number well above $6B.

- The global virtual desktop infrastructure market is expected to grow from $13.81 billion in 2022 to $16.17 billion in 2023 at a compound annual growth rate (CAGR) of 17.1%. The virtual desktop infrastructure market is expected to grow to $30.63 billion in 2027 at a CAGR of 17.3%. This is according to the Research and markets “Virtual Desktop Infrastructure Global Market Report 2023” as reported by Yahoo Finance News.

- according to the latest Gartner Magic Quadrant for Desktops as a Service.

- https://www.prnewswire.com/news-releases/dizzion-acquires-frame-from-nutanix-to-accelerate-growth-in-daas-market-301842568.html#:~:text=DENVER%2C%20June%206%2C%202023%20%2F,Nutanix%20(NASDAQ%3A%20NTNX)

- Windows 10 and 11 https://www.zdnet.com/article/hoping-for-a-windows-10-support-extension-microsoft-just-quietly-crushed-your-dreams/

- Why the end of Windows 10 could be a big problem https://www.youtube.com/watch?v=M7N–Zf-Ypo