Security and Compliance

Cybersecurity Insurance and Risk Management: Key Insights for IT Leadership

Topics: Security and Compliance

In an alarming reminder of the pervasive cyber threats facing businesses today, major IT services company Infosys recently reported a significant “security event.” This incident disrupted several applications in their U.S. unit. The company is still unraveling the full extent of the attack’s impact. Similarly, aerospace giant Boeing faced a “cyber incident” this fall that affected multiple business elements, with the LockBit ransomware gang claiming responsibility. Despite the company’s assurance of no impact on flight safety, the breach’s broader implications are another stark wake-up call for IT managers.

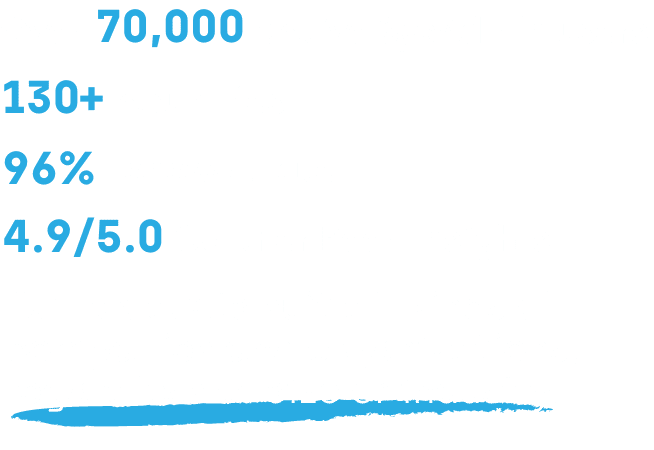

Cybersecurity threats loom larger than ever, and IT managers find themselves at the frontline, defending against potential financial and reputational harm. Recast Software, in partnership with the Ponemon Institute, recently polled over 600 IT leaders to inquire about their cybersecurity insurance experience and policies. The data make clear that the stakes are high—the average financial toll of a data breach now sits at $21 million.* These breaches are more than just disruptive; they undermine customer trust while putting organizations at serious financial risk.

This post highlights crucial data and strategies pulled from a more comprehensive survey and report co-created with the Ponemon Institute. The complete report*, as well as this post, serve to lead IT managers through the current cybersecurity and cyber insurance landscape. Let’s dig in.

Cybersecurity Insurance: A Critical Evaluation

The substantial financial strain of a data breach naturally leads companies to lean into cybersecurity insurance as a financial buffer. However, this safeguarding strategy isn’t a singular solution to your security concerns. Satisfaction levels with insurers show significant variance, suggesting that insurance alone will not bring you peace of mind. Indeed, organizations find that on average, only 46% of their breach-related expenses were recouped through insurance claims. This figure highlights the necessity for IT leaders to scrutinize their insurance policies thoroughly and to bolster their internal security protocols as the primary line of defense.

Assessing Cyber Risk

Despite the known risks, a full 21% of organizations skip cyber risk assessments altogether—a perilous omission that leaves them vulnerable. Those that do engage in risk assessments often lack a standardized approach. A rigorous and repeatable risk assessment protocol is crucial to uncover the often subtle and complex vulnerabilities that could be exploited. We recommend starting with our Cybersecurity Insurance Checklist to begin your assessment process.

Human Error: No Small Matter

The human fallibility factor cannot be overstated when assessing cybersecurity risk and formalizing protocols. Over half of the surveyed organizations have experienced the consequences of human error, which can lead to data breaches and hacks.

Any serious cybersecurity strategy must include comprehensive cybersecurity awareness and training to minimize these risks. Such a program should be dynamic, incorporating regular updates to reflect the latest threat landscape and learning from past incidents.

Recast Software: A Strategic Ally in Risk Management

The integration of Recast Software’s product suite provides an upper hand in preemptively managing potential risks. The suite’s capabilities directly target many critical areas within security protocols required by cybersecurity insurance vendors:

- Vulnerability Remediation: With tools that manage local user groups and enforce role-based access controls, Recast Software stands as a sentinel against vulnerabilities that could be exploited due to excessive user privileges or outdated applications.

- Application and Patch Management: Application Manager’s deployment capabilities extend to monitoring the lifecycle of software, ensuring that every vulnerability is rapidly patched and every change is accounted for.

- Access and Identity Management: Privilege Manager’s functionality ensures that user access is both necessary and appropriate, reducing the potential for insider threats or accidental misuse of privileges.

Cybersecurity Insurance and Risk Management

Secure Your Digital Future

Grasping the intricacies of your cyber risk, including the nuances of cybersecurity insurance, is non-negotiable for IT leaders committed to safeguarding their organizations. With a staggering 47% of organizations anticipating an increase in cyber risk*, the urgent need to solidify your cybersecurity stance is palpable.

Recast Software is positioned to elevate your cybersecurity readiness from reactive to proactive, transforming insights into tangible protection. Reach out to discover how our tools can integrate into your security framework, providing a systematic, streamlined approach to risk management.

* Data from a cybersecurity insurance poll executed by the Ponemon Institute in partnership with Recast Software. Full report coming soon.